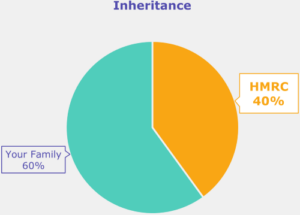

However wealthy you are, if you don’t optimise your resources from an Inheritance Tax (IHT) perspective, HMRC will confiscate 40% of everything when you die.

Know this: it’s entirely legal to plan to avoid having to pay IHT upon death

Most of us go through life functioning at a fraction of capacity. Our attention flickers. When we work we think about play. When we play we think about work. We check emails while we’re on Zoom. Our most scarce resource isn’t money, it’s our time and attention

Need proof? Check where your phone is, right now. Bet it’s within arm’s reach!

There’s no way to leverage attention, it’s on one thing, at one time. Our reality is defined by what we pay attention to, and we must be aware of our own limitations

The way to give such an important topic as IHT planning your complete attention, is to delegate it to experts. Real experts

Those who say it can’t be done shouldn’t interrupt our team of Chartered Tax Advisors who are doing it, daily. You provide the ingredients, we’ll provide the recipe, and we’ll work on the flavour together, for you

It’s not one and done. Your IHT planning requires monitoring, and amending, as the law and your goals change, and HMRC continually move the goalposts

It doesn’t stop there either. In our world, Chartered Tax Advisors take care of all your tax, and can even handle probate for your family when you die, all for a fixed fee. That’s real peace of mind

You’re in safe hands. So, for you, time for ‘deep work, deep play, deep rest, deep listening, deep sleeping, deep love, deep everything’, to quote Cal Newport

Let us review your IHT planning with you. Experience the Power of a FREE Hour here

Toodle pip